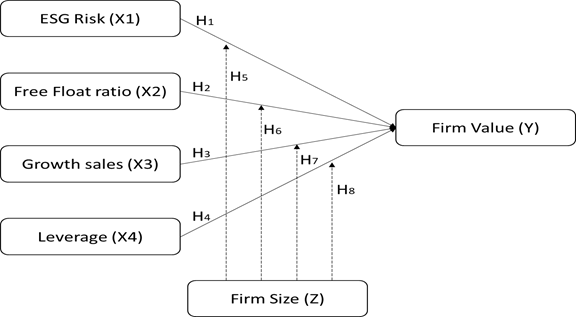

Impact of ESG Risk, Free Float, Growth, and Leverage on LQ45 Firm Value Moderated by Size

Keywords:

esg risk, Sustainable, Firm Value, Growth ratio, LeverageAbstract

This study examines the impact of financial factors on firm value, both directly and through the moderation of firm size. Using secondary data from companies listed in the LQ45 index on the Indonesia Stock Exchange from 2021 to 2024, the study analyzes variables such as ESG risk, free float ratio, sales growth, leverage, and firm size. Multiple linear regression analysis was performed with STATA 17 to assess the relationships between these variables and firm value. The findings reveal that ESG risk has no significant effect on firm value but becomes positive when moderated by firm size in large companies. The free float ratio positively impacts firm value, but this effect turns negative for larger companies, indicating a lack of market control. The growth sales ratio shows no significant effect on firm value, and leverage has a positive impact, which turns negative in larger firms due to higher financial risks. This study suggests that large firms should focus on managing ESG risks and leverage carefully, while small companies can use the free float ratio to boost liquidity. Limitations of the study include the focus on LQ45 companies, which may not represent all sectors, and future research should consider broader industry samples

References

Abdi, Y., Li, X., & Càmara-Turull, X. (2022). Exploring the impact of sustainability (ESG) disclosure on firm value and financial performance (FP) in airline industry: the moderating role of size and age. Environment, Development and Sustainability, 24(4), 5052–5079. https://doi.org/10.1007/s10668-021-01649-w

Abigail, P. Y. D. (2024). 10 Emiten LQ45 Catatkan Penurunan Laba di 2023, Siapa Saja? Katadata.Co.Id. https://katadata.co.id/finansial/korporasi/65f15ef387413/10-emiten-lq45-catatkan-penurunan-laba-di-2023-siapa-saja

Adams, C. A., & Larrinaga‐González, C. (2007). Engaging with organisations in pursuit of improved sustainability accounting and performance. Accounting, Auditing & Accountability Journal, 20(3), 333–355. https://doi.org/10.1108/09513570710748535

Adhi, R. E., & Cahyonowati, N. (2023). Pengaruh Environmental, Social dan GOvernance Disclosure terhadap Nilai perusahaan dengan Ukuran perusahaan sebagai variabel Moderasi (Studi Empiris Perusahaan Non-Keuangan di Bursa Efek Indonesia Tahun 2019-2021). Diponegoro Journal of Accounting, 12(3), 1–12.

Ahmad, N., Mobarek, A., & Roni, N. N. (2021). Revisiting the impact of ESG on financial performance of FTSE350 UK firms: Static and dynamic panel data analysis. Cogent Business & Management, 8(1), 1900500.

Albuquerque, R., Koskinen, Y., & Zhang, C. (2019). Corporate Social Responsibility and Firm Risk: Theory and Empirical Evidence. Management Science, 65(10), 4451–4469. https://doi.org/10.1287/mnsc.2018.3043

Alfajri, M. D., & Warsini, S. (2024). Analisis Komprehensif Pengaruh ESG Risk Rating dan Leverage Terhadap Firm Value Serta Implikasinya Pada IDXESGL. Seminar Nasional Akuntansi Dan Manajemen PNJ, 5(1). https://prosiding.pnj.ac.id/SNAM/article/view/2655

Ana, S., & Wibowo, D. T. (2025). Nilai Perusahaan dalam Formula Tobin’s Q Ratio. MUQADDIMAH: Jurnal Ekonomi, Manajemen, Akuntansi Dan Bisnis, 3(1).

Anjani, A. F., & Yuliana, I. (2023). Peran Moderasi Ukuran Perusahaan terhadap Hubungan Leverage dan Likuiditas terhadap Nilai Perusahaan. Ekonomis: Journal of Economics and Business, 7(1), 146. https://doi.org/10.33087/ekonomis.v7i1.751

Apriliyanti, V., Hermi, H., & Herawaty, V. (2019). Pengaruh Kebijakan Hutang, Kebijakan deviden, Profitabilitas, Pertumbuhan Penjualan dan Kesempatan Investasi terhadap Nilai Perusahaan dengan ukuran prusahaan sebagai variabel Moderasi. Jurnal Magister Akuntansi Trisakti, 6(2), 201–224. https://doi.org/10.25105/jmat.v6i2.5558

Ariasinta, T., Indarwanta, D., & Utomo, H. J. N. (2024). Pengaruh Environmental, Social, and Governance (ESG) Disclosure Dan Intellectual Capital Terhadap Firm Value Dengan Firm Size Sebagai Variabel Moderasi (Studi Pada Perusahaan Indeks LQ45 Tahun 2018-2022). Jurnal Administrasi Bisnis (JABis), 22(2), 255. https://doi.org/10.31315/jurnaladmbisnis.v22i2.12832

Aydoğmuş, M., Gülay, G., & Ergun, K. (2022). Impact of ESG performance on firm value and profitability. Borsa Istanbul Review, 22, S119–S127. https://doi.org/10.1016/j.bir.2022.11.006

Aziz, N. A. A., Manab, N. A., & Othman, S. N. (2016). Critical Success Factors of Sustainability Risk Management (SRM) Practices in Malaysian Environmentally Sensitive Industries. Procedia - Social and Behavioral Sciences, 219, 4–11. https://doi.org/10.1016/j.sbspro.2016.04.025

Bostancı, F., & Kılıç, S. (2010). The Effects of Free Float Ratios on Market Performance: An Empirical Study on The Istanbul Stock Exchange.

Brealey, R. A., Myers, S. C., Allen, F., & Mohanty, P. (2018). Principles of corporate finance. In McGraw-Hill Education (12th ed.). McGraw-Hill Education.

Brigham, E. F., & Houston, J. F. (2019). Fundamentals of Financial Management. In Cegage Learning (Vol. 34, Issue 5).

Bukhori, M. R. T., & Sopian, D. (2017). Pengaruh Pengungkapan Sustainability Report terhadap Kinerja Keuangan. Jurnal Sikap, 2(1), 35–48.

Cashmere. (2014). Analysis of Financial Statements (7th ed.). PT Raja Grafindo Persada.

Cohen, G. (2023). The impact of ESG risks on corporate value. Review of Quantitative Finance and Accounting, 60(4), 1451–1468. https://doi.org/10.1007/s11156-023-01135-6

D’Amato, A., & Falivena, C. (2020). Corporate social responsibility and firm value: Do firm size and age matter? Empirical evidence from European listed companies. Corporate Social Responsibility and Environmental Management, 27(2), 909–924. https://doi.org/10.1002/csr.1855

Deegan, C. (2014). Financial Accounting Theory. McGraw-Hill Education (Australia) Pty Limited. https://books.google.co.id/books?id=zH-_BQAAQBAJ

Dian, L. (2019). Pengaruh Rasio Free Float Terhadap Likuiditas Saham Perusahaan Tercatat Di Bursa Efek Indonesia. UGM Yogyakarta.

Ding, X. (Sara), Ni, Y., & Zhong, L. (2016). Free float and market liquidity around the world. Journal of Empirical Finance, 38, 236–257. https://doi.org/10.1016/j.jempfin.2016.07.002

Dolontelide, C. M., & Wangkar, A. (2019). Pengaruh Sales Growth dan Firm Size Terhadap Nilai Perusahaan. Jurnal EMBA, 7(3), 3039–3048.

Ducassy, I., & Montandrau, S. (2015). Corporate social performance, ownership structure, and corporate governance in France. Research in International Business and Finance, 34, 383–396. https://doi.org/10.1016/j.ribaf.2015.02.002

Dwiastuti, D. S., & Dillak, V. J. (2019). Pengaruh Ukuran Perusahaan, Kebijakan Hutang, dan Profitabilitas Terhadap Nilai Perusahaan. Jurnal ASET (Akuntansi Riset), 11(1), 137–146. https://doi.org/10.17509/jaset.v11i1.16841

Dzahabiyya, J., Jhoansyah, D., & Danial, R. D. M. (2020). Analisis Nilai Perusahaan Dengan Model Rasio Tobin’s Q. JAD : Jurnal Riset Akuntansi & Keuangan Dewantara, 3(1), 46–55. https://doi.org/10.26533/jad.v3i1.520

Eccles, R. G., & Youmans, T. (2015). Implied Materiality and Material Disclosures of Credit Ratings. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2592630

El-Nader, G. (2018). Stock liquidity and free float: evidence from the UK. Managerial Finance, 44(10), 1227–1236. https://doi.org/10.1108/MF-12-2017-0494

Eriandani, R., & Winarno, W. A. (2024). ESG Risk and Firm Value: The Role of Materiality in Sustainability Reporting. Quality Innovation Prosperity, 28(2). https://doi.org/10.12776/qip.v28i2.2019

Fachrezi, M. F., Fauziah, S., Iqbal, M., & Firmansyah, A. (2024). ESG Risk Dan Nilai Perusahaan Di Indonesia. Akuntansiku, 3(2), 64–76. https://doi.org/10.54957/akuntansiku.v3i2.691

Fahmi, I. (2012). Pengantar Manajemen Keuangan Teori dan Soal Jawab. Alfabeta.

Failisa, A., Syamsuri, P., & Selong, A. (2024). The Effect of Profitability, Company Size, and Leverage on Company Value with Financial Distress as an Intervening Variable. Journal of Management & Business, 7(1), 761–776. https://www.journal.stieamkop.ac.id/index.php/seiko/article/download/6474/4354&hl=en&sa=X&d=16447819435138509549&ei=I7kLZvSqC7aw6rQP-_-h-As&scisig=AFWwaeYsgYC7anMXaTukw36vu2ja&oi=scholaralrt&hist=3wEYSwsAAAAJ:16254794699168785533:AFWwaeZMyzJN4ud8ggCfTxH7o

Fatemi, A., Glaum, M., & Kaiser, S. (2018). ESG performance and firm value: The moderating role of disclosure. Global Finance Journal, 38, 45–64. https://doi.org/10.1016/j.gfj.2017.03.001

Ferriani, F., & Natoli, F. (2021). ESG risks in times of Covid-19. Applied Economics Letters, 28(18), 1537–1541. https://doi.org/10.1080/13504851.2020.1830932

Firmansyah, A., Hadi, N., Sheila, S., & Trisnawati, E. (2022). Respon pasar atas pengungkapan keberlanjutan pada perusahaan perbankan di Indonesia: Peran Ukuran Perusahaan. Bina Ekonomi, 25(2). https://doi.org/10.26593/be.v25i2.5339.97-111

Fitriani, D., Iqbal, S., & Andayani, W. (2020). Efektifitas Free Float dalam mendongkrak Likuiditas Bursa Efek Indonesia. MIX JURNAL ILMIAH MANAJEMEN, 10(1), 127. https://doi.org/10.22441/mix.2020.v10i1.009

Fraser, L. M., & Ormiston, A. (2001). Understanding Financial Statements. Prentice Hall. https://books.google.co.id/books?id=F1EPAQAAMAAJ

Freeman, R. E. (2010). Strategic management: A stakeholder approach. Cambridge university press.

Friedman, A. L., & Miles, S. (2006). Stakeholders: Theory and Practice. OUP Oxford. https://books.google.co.id/books?id=ITD8VWJGOYYC

Gani, F., Munthe, I. L. S., & Yusyawiru, N. (2025). The Importance of Disclosure and Transparency in Enhancing Firm Value: A Study on the LQ45 Index. Jurnal Ilmiah Akuntansi Dan Finansial Indonesia, 9(1), 23–36. https://doi.org/10.31629/45wtbk02

Garz, H., & Volk, C. (2018). The ESG Risk Ratings: Moving up the innovation curve. https://connect.sustainalytics.com/hubfs/INV - Reports and Brochure/Thought Leadership/SustainalyticsESGRiskRatings_WhitePaperVolumeOne_October 2018.pdf

Gunarsih, T. (2024). Is Firm Size Strengthening the Relationship Between ESG Disclosure and Firm Valur? A Study inIDX ESG Leader. August.

Gusty, M. I., & Novian. (2022). Pengaruh Struktur Modal dan Kepemilikan Institusional terhadap Nilai Perusahaan dengan Ukuran Perusahaan sebagai Variabel Moderasi (Studi Empiris Pada Perusahaan Barang dan Konsumsi yang Terdaftar di BEI tahun 2016-2020) [Darma Persada]. http://repository.unsada.ac.id/5073/

Hales, J. (2018). The Future of Accounting Is Now. CPA Journal, 88(7).

Harahap, A. F., Listiorini, & Ika, D. (2023). Pengaruh Profitabilitas, Likuiditas Dan Leverage Terhadap Kebijakan Dividen Dengan Size Sebagai Variabel Moderating. Jurnal Akutansi Manajemen Ekonomi Kewirausahaan (JAMEK), 3(1), 1–10. https://doi.org/10.47065/jamek.v3i1.344

Herdiani, N. P., Badina, T., & Rosiana, R. (2021). Pengaruh Likuiditas, Leverage, Kebijakan Dividen, Ukuran Perusahaan, Good Corporate Governance dan Sales Growth Terhadap Nilai Perusahaan. Akuntansi Dan Manajemen, 16(2). https://doi.org/10.30630/jam.v16i2.157

Hermanda, W. K., & Wijaya, R. E. (2020). CSR Performance and ESG Risk terhadap nilai dan kesehatan keuangan perusahaan non-financial terdaftar Bursa Efek Indonesia Periode 2019 - 2022. Jurnal Ilmiah Wahana Pendidikan, 8(9). https://doi.org/10.5281/zenodo

Ibrahim, S. M., & Hanggraeni, D. (2021). Penyebaran Kepemilikan, Likuiditas, dan Nilai Perusahaan: Bukti Dari Indonesia. Syntax Literate ; Jurnal Ilmiah Indonesia, 6(12), 6396. https://doi.org/10.36418/syntax-literate.v6i12.5055

Isti Handayani, & Wuri Septi Handayani. (2024). Pengaruh Sales Growth, Ukuran Perusahaan, Profitabilitas, Likuiditas dan Leverage terhadap Nilai Perusahaan. MENAWAN : Jurnal Riset Dan Publikasi Ilmu Ekonomi, 2(5), 310–327. https://doi.org/10.61132/menawan.v2i5.848

Jaya, S. (2020). Pengaruh Ukuran Perusahaan (Firm Size) dan Profitabilitas (ROA) Terhadap Nilai Perusahaan (Firm Value) Pada Perusahaan Sub Sektor Property dan Real Estate di Bursa Efek Indonesia (BEI). Jurnal Manajemen Motivasi, 16(1). https://doi.org/10.29406/jmm.v16i1.2136

Jihadi, M., Vilantika, E., Hashemi, S. M., Arifin, Z., Bachtiar, Y., & Sholichah, F. (2021). The Effect of Liquidity, Leverage, and Profitability on Firm Value: Empirical Evidence from Indonesia. Journal of Asian Finance, Economics and Business, 8(3). https://doi.org/10.13106/jafeb.2021.vol8.no3.0423

Kao, M.-F., Hodgkinson, L., & Jaafar, A. (2019). Ownership structure, board of directors and firm performance: evidence from Taiwan. Corporate Governance: The International Journal of Business in Society, 19(1), 189–216. https://doi.org/10.1108/CG-04-2018-0144

Kerestecioğlu, S., & Caliskan, M. M. T. (2013). Effects of Free Float Ratios on Stock Prices: An Application on ISE. Doğuş Üniversitesi Dergisi, 2(14), 165–174. https://doi.org/10.31671/dogus.2018.104

Kristofel, Van Rate, P., & Loindong, S. S. R. (2023). Pengaruh leverage, profitabilitas, ukuran perusahaan dan kepemilikan terkonsentrasi terhadap nilai perusahaan pada Perusahaan property dan real estate di Bursa Efek Indonesia Periode 2016 - 2020. Jurnal EMBA : Jurnal Riset Ekonomi, Manajemen, Bisnis Dan Akuntansi, 11(02), 44–55. https://doi.org/10.35794/emba.v11i02.47652

Lerskullawat, P., & Ungphakorn, T. (2024). ESG Performance, Ownership Structure and Firm Value: Evidence from ASEAN-5. ABAC Journal, 44(4). https://doi.org/10.59865/abacj.2024.63

Li, Y., Gong, M., Zhang, X.-Y., & Koh, L. (2018). The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. The British Accounting Review, 50(1), 60–75. https://doi.org/10.1016/j.bar.2017.09.007

Lonkani, R. (2018). Firm Value. In Firm Value - Theory and Empirical Evidence. InTech. https://doi.org/10.5772/intechopen.77342

Maiti, M. (2020). A Critical Review On Evolution of Risk Factors and Factor Models. Journal of Economic Surveys, 34(1), 175–184. https://doi.org/10.1111/joes.12344

Michelon, G., & Parbonetti, A. (2012). The effect of corporate governance on sustainability disclosure. Journal of Management and Governance, 16(3). https://doi.org/10.1007/s10997-010-9160-3

Nurhaeda, A. (2019). Pengaruh Free Float Terhadap Likuiditas Saham Pada Perusahaan-Perusahaan Yang Tercatat Di Bursa Efek Indonesia. Tangible Journal, 4(2), 231–244. https://doi.org/10.47221/tangible.v4i2.81

Olsen, B. C., Awuah-Offei, K., & Bumblauskas, D. (2021). Setting materiality thresholds for ESG disclosures: A case study of U. S. mine safety disclosures. Resources Policy, 70, 101914. https://doi.org/10.1016/j.resourpol.2020.101914

Orcan, F. (2020). Parametric or Non-parametric: Skewness to Test Normality for Mean Comparison. International Journal of Assessment Tools in Education, 7(2), 255–265. https://doi.org/10.21449/ijate.656077

Pamungkas, A. C., & Risman, A. (2024). Literature Review: Manajemen Risiko Environmental, Social, and Governance (ESG) Dalam Bisnis Berkelanjutan. Jurnal Doktor Manajemen, 7(2). https://doi.org/10.22441/jdm.v7i2.28308

Paniagua, J., Rivelles, R., & Sapena, J. (2018). Corporate governance and financial performance: The role of ownership and board structure. Journal of Business Research, 89, 229–234. https://doi.org/10.1016/j.jbusres.2018.01.060

Rejeki, H. T., & Haryono, S. (2021). Pengaruh Leverage Dan Ukuran Perusahaan Terhadap Nilai Perusahaan Di Indonesia. Invoice : Jurnal Ilmu Akuntansi, 3(1), 1–9. https://doi.org/10.26618/inv.v3i1.4969

Rhee, S. G., & Wang, J. (2009). Foreign institutional ownership and stock market liquidity: Evidence from Indonesia. Journal of Banking & Finance, 33(7), 1312–1324. https://econpapers.repec.org/RePEc:eee:jbfina:v:33:y:2009:i:7:p:1312-1324

Rizky. (2021). Pengaruh Profitabilitas dan leverage terhadap nilai perusahaan dengan ukuran perusahaan sebagai variabel moderasi pada perusahaan makanan dan minuman yang terdaftar di BEI 2018-2020 [Sekolah Tinggi Ilmu Ekonomi Indonesia]. http://repository.stei.ac.id/id/eprint/5743

Roestanto, A., Vivianita, A., & Nurkomalasari, N. (2022). Pengaruh Ukuran Perusahaan, Umur Perusahaan, Jenis Industri, dan Struktur Kepemilikan Terhadap Environmental, Social, and Governance (ESG) Disclosure. Jurnal Akuntansi STIE Muhammadiyah Palopo, 8(1), 1–18.

Rosmita Rasyid, R. E. (2019). Pengaruh Firm Size, Profitability, Sales Growth, Dan Leverage Terhadap Firm Value Pada Perusahaan Manufaktur Yang Terdaftar Di Bei Pada Tahun 2015-2017. Jurnal Paradigma Akuntansi, 1(2), 468. https://doi.org/10.24912/jpa.v1i2.5016

Rosyidani, N. M., Rahma, G. A., Rahayu, L., Putri, M., & Handayani, W. T. (2024). Analisa Pengaruh Daya Tarik Influencer Terhadap Niat Pembelian Melalui Kepercayaan Masyarakat. Jurnal Ekonomi Dan Kewirausahaan West Science, 2(02), 273–281. https://doi.org/10.58812/jekws.v2i02.773

Safitri, N., Setiatin, T., Zaelani, R., Zaky, M., & Suaebah, E. (2024). Unveiling the Green Treasure Trove to Unlocking Sustainability: Exploring the Value of Green Intellectual Capital and Green Accounting. Jurnal Proaksi, 11(1), 30–47. https://doi.org/10.32534/jpk.v11i1.5482

Santoso, B. A., & Junaeni, I. (2022). Pengaruh Profitabilitas, Leverage, Ukuran Perusahaan, Likuiditas, dan Pertumbuhan Perusahaan Terhadap Nilai Perusahaan. Owner, 6(2). https://doi.org/10.33395/owner.v6i2.795

Saona, P., & San Martín, P. (2018). Determinants of firm value in Latin America: an analysis of firm attributes and institutional factors. Review of Managerial Science, 12(1), 65–112. https://doi.org/10.1007/s11846-016-0213-0

Sari, W. A., & Rachman, A. N. (2021). The effect of free float ratio and profitability on stock price. Berkala Akuntansi Dan Keuangan Indonesia, 6(2). https://doi.org/10.20473/baki.v6i2.25500

Sekaran, U. (2021). Research Methods for Busniness. In The Encyclopedia of Research Methods in Criminology and Criminal Justice: Volume II: Parts 5-8.

Siahaan, R. T., & Muslih, M. (2020). The Effect of Profitability, Debt Policy, and Sales Growth to Firm Value (Study of Food and Beverage Sub Sector Manufacturing Companies Listed on the Indonesia Stock Exchange Period of 2015-2018). E-Proceeding of Management, 7(2).

Spence, M. (1973). Job market signaling. Quarterly Journal of Economics, 87(3). https://doi.org/10.2307/1882010

Sugiharto, S. A., & Hendratno, H. (2022). Pengaruh pertumbuhan perusahaan, free cash flow dan investment opportunity set atas nilai perusahaan. Jurnal Ilmiah Manajemen, Ekonomi, & Akuntansi (MEA), 6(3). https://doi.org/10.31955/mea.v6i3.2430

Tandelilin, E. (2017). Pasar modal manajemen portofolio & investasi. Yogyakarta: PT Kanisius.

Wibawa, D. S., & Khomsiyah, K. (2022). Pengaruh Lingkungan Yang Dimoderasi Oleh Ukuran Perusahaan Terhadap Nilai Perusahaan Pada Pandemi Covid-19. Owner, 6(4). https://doi.org/10.33395/owner.v6i4.1189

Widarjo, W., & Setiawan, D. (2009). Pengaruh Rasio Keuangan terhadap Kondisi Financial Distress Perusahaan Otomotif. Jurnal Bisnis Dan Akuntansi, 11(2). https://doi.org/10.34208/jba.v11i2.174

Widianto, R., & Astuti, C. (2024). Pengaruh Enterprise Risk Management, Kualitas Audit Eksternal, Dan ESG Disclosure Terhadap Nilai Perusahaan. Journal of Economic, Bussines and Accounting (COSTING), 7, 4307–4318. https://doi.org/10.31539/costing.v7i3.9125

Younas, Z. I., & Zafar, A. (2019). Corporate risk taking and sustainability: a case of listed firms from USA and Germany. Journal of Global Responsibility, 10(1), 2–15. https://doi.org/10.1108/JGR-07-2018-0027

Downloads

Published

How to Cite

Conference Proceedings Volume

Section

License

Copyright (c) 2025 Aditya Wardana, Khoirul Hikmah, Widhy Tri Astuti

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.