The CFE Model of SME Financial Performance: Does Financial Literacy Really Matter?

Keywords:

financial literacy, financial management practices, entrepreneurial orientation, adequacy, capital SME financial performanceAbstract

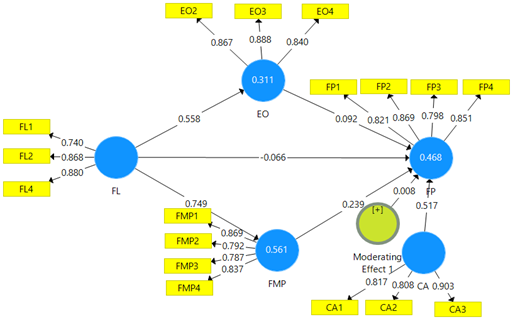

Small and medium enterprises (SMEs) are the backbone of emerging economies, yet their financial performance remains constrained by low financial literacy, limited capital, and weak managerial orientation. Prior studies show inconsistent findings on the direct impact of financial literacy on SME performance, suggesting the presence of mediating and moderating mechanisms that warrant systematic exploration. This study develops and tests the CFE model—Capital Adequacy, Financial Management Practices, and Entrepreneurial Orientation—to explain SME financial performance in Indonesia. Drawing on 110 SMEs in West Nusa Tenggara, data were collected through structured questionnaires in September 2025 and analyzed using structural equation modeling with Smart PLS 3.0. The results reveal that financial literacy has no direct effect on financial performance but exerts a significant indirect effect through dual mediation. Financial management practices emerge as the strongest mediator, while entrepreneurial orientation partially mediates the relationship. Contrary to expectations on previous studies, capital adequacy does not moderate the relationship but acts as a significant antecedent directly influencing financial performance. The model explains 44.2% of the variance in SME financial performance. These findings highlight that financial knowledge alone is insufficient; it must be consistently implemented through sound financial management practices to yield performance gains. The study contributes theoretically by integrating the Resource-Based View with Behavioral Theory and practically by offering policy implications that call for holistic SME development programs combining financial literacy training, practical mentoring, and entrepreneurial mindset enhancement.

References

Abdallah, W., Harraf, A., Ghura, H., & Abrar, M. (2024). Financial literacy and small and medium enterprises performance: the moderating role of financial access. Journal of Financial Reporting and Accounting, ahead-of-p(ahead-of-print). https://doi.org/10.1108/JFRA-06-2024-0337

Abdallah, W., Harraf, A., Ghura, H., & Abrar, M. (2025). Financial literacy and small and medium enterprises performance: the moderating role of financial access. Journal of Financial Reporting and Accounting, 23(4), 1345–1364. https://doi.org/https://doi.org/10.1108/JFRA-06-2024-0337

Addin Al-Mawsheki, R. M. S. (2022). Effect of working capital policies on firms’ financial performance. Cogent Economics & Finance, 10(1), 2087289. https://doi.org/https://doi.org/10.1080/23322039.2022.2087289

Adomako, S., & Ahsan, M. (2022). Entrepreneurial passion and SMEs’ performance: Moderating effects of financial resource availability and resource flexibility. Journal of Business Research, 144, 122–135. https://doi.org/10.1016/j.jbusres.2022.02.002

Ahinful, G. S., Boakye, J. D., & Osei Bempah, N. D. (2023). Determinants of SMEs’ financial performance: evidence from an emerging economy. Journal of Small Business and Entrepreneurship, 35(3), 362–386. https://doi.org/10.1080/08276331.2021.1885247

Akhtar, S., & Liu, Y. (2018). SME Managers and Financial Literacy; Does Financial Literacy Really Matter? Journal of Public Administration and Governance, 8(3), 353. https://doi.org/10.5296/jpag.v8i3.13539

Ali, H., & Li, Y. (2021). Financial Literacy, Network Competency, and SMEs Financial Performance: The Moderating Role of Market Orientation. Journal of Asian Finance, 8(10), 341–0352. https://doi.org/10.13106/jafeb.2021.vol8.no10.0341

BPS. (2024). Profil Industri Mikro dan Kecil di NTB 2022 (Vol. 5). BPS NTB. https://ntb.bps.go.id/id/publication/2024/04/30/6e29d5e76f787a008a349113/profil-industri-mikro-kecil-provinsi-nusa-tenggara-barat-2022.html

El-Ansary, O., & Al-Gazzar, H. (2021). Working capital and financial performance in MENA region. Journal of Humanities and Applied Social Sciences, 3(4), 257–280. https://doi.org/10.1108/JHASS-02-2020-0036

Fatoki, O. (2021). Access to finance and performance of small firms in South Africa: The moderating effect of financial literacy. WSEAS Transactions on Business and Economics, 18, 78–87. https://doi.org/10.37394/23207.2021.18.9

Hair Jr, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., Danks, N. P., & Ray, S. (2022). Partial Least Squares Structural Equation Modeling (PLS-SEM) Using R: A Workbook. Springer Nature.

Hossain, M. M., Ibrahim, Y., & Uddin, M. M. (2023). Finance, financial literacy and small firm financial growth in Bangladesh: the effectiveness of government support. Journal of Small Business & Entrepreneurship, 35(3), 336–361. https://doi.org/10.1080/08276331.2020.1793097

Huston, S. J. (2010). Measuring financial literacy. Journal of Consumer Affairs, 44(2), 296–316. https://onlinelibrary.wiley.com/doi/pdfdirect/10.1111/j.1745-6606.2010.01170.x

Isibor, N. J., Ibeh, A. I., Ewim, C. P.-M., Sam-Bulya, N. J., & Martha, E. (2022). A financial control and performance management framework for SMEs: Strengthening budgeting, risk mitigation, and profitability. International Journal of Multidisciplinary Research and Growth Evaluation, 3(1), 761–768. https://doi.org/https://doi.org/10.54660/.IJMRGE.2022.3.1.761-768

Istighfariani, N., Ferdinand, A. T., & Arif, A. R. (2024). The Influence Of Entrepreneurial Orientation, Product Knowledge, And Financial Literacy On Business Performance Improvement With Product Innovation Capability As An Intervening Variable. The International Journal of Business Review (The Jobs Review), 17(2), 1–14. https://doi.org/https://doi.org/10.17509/tjr.v7i2.80592

Kalinic, I., & Brouthers, K. D. (2022). Entrepreneurial orientation, export channel selection, and export performance of SMEs. International Business Review, 31(1), 101901. https://doi.org/10.1016/j.ibusrev.2021.101901

Kaplan, R. S., & Norton, D. P. (2001). Transforming the balanced scorecard from performance measurement to strategic management: Part II. Accounting Horizons, 15(2), 147–160. https://www.hbs.edu/faculty/Pages/item.aspx?num=8890

Kementerian Koperasi dan UKM. (2022). Paten Program Adaptasi Dan Transformasi Ekonomi Nasional. Tabloid Kementerian Koperasi Dan UKM, 1–39. https://satudata.kemenkopukm.go.id/file/arsip/752ded2a-b156-4032-b155-21c874f06931.pdf?type=download

Khan, M. A., Siddique, A., Sarwar, Z., Minh Huong, L. T., & Nadeem, Q. (2020). Determinants of entrepreneurial small and medium enterprises performance with the interaction effect of commercial loans. Asia Pacific Journal of Innovation and Entrepreneurship, 14(2), 161–173. https://doi.org/10.1108/apjie-11-2019-0079

Kock, N. (2021). Harman’s single factor test in PLS-SEM: Checking for common method bias. Data Analysis Perspectives Journal, 2(2), 1–6. https://scriptwarp.com/dapj/2021_DAPJ_2_2/Kock_2021_DAPJ_2_2_HarmansCMBTest.pdf

Lestari, B. A. H., Jumaidi, L. T., & Nabila, D. T. Della. (2022). Akuntansi Bagi Usaha Kecil Menengah (Survei Pada UKM Di NTB). Jurnal Inovasi Penelitian, 3(1), 4361–4370. https://garuda.kemdiktisaintek.go.id/documents/detail/2761026

Lumpkin, G. T., & Dess, G. G. (1996). Clarifying the entrepreneurial orientation construct and linking it to performance. Academy of Management Review, 21(1), 135–172. http://www.jstor.org/stable/258632

Lusardi, A., & Mitchell, O. (2011). Financial Literacy Around The World. Journal of Pension Economics and Finance, 10(4), 497–508. https://doi.org/https://doi.org/10.1017/S1474747211000448

Mang’ana, K. M., Ndyetabula, D. W., & Hokororo, S. J. (2023). Financial management practices and performance of agricultural small and medium enterprises in Tanzania. Social Sciences & Humanities Open, 7(1), 100494. https://doi.org/https://doi.org/10.1016/j.ssaho.2023.100494

Mantok, S., Sekhon, H., Sahi, G. K., & Jones, P. (2019). Entrepreneurial orientation and the mediating role of organisational learning amongst Indian S-SMEs. Journal of Small Business and Enterprise Development, 26(5), 641–660. https://doi.org/10.1108/JSBED-07-2018-0215

Mashal, A. (2017). Do Non-Financial Factors Matter for SMEs Performance? “Case from Jordan.” Business and Economics Journal, 08(04). https://doi.org/10.4172/2151-6219.1000323

OJK. (2017). Edukasi dan Perlindungan Konsumen. https://www.ojk.go.id/id/kanal/edukasi-dan-perlindungan-konsumen/regulasi/surat-edaran-ojk/Documents/SAL SEOJK 30 - Literasi Keuangan.pdf

OJK. (2022). Survei Nasional Literasi dan Inklusi. In Siaran Pers (pp. 1–3). Otoritas Jasa Keuangan. https://www.ojk.go.id/id/berita-dan-kegiatan/publikasi/Pages/Survei-Nasional-Literasi-dan-Inklusi-Keuangan-2019.aspx#:~:text=Survei Nasional Literasi dan Inklusi Keuangan (SNLIK) ketiga yang dilakukan,inklusi keuangan 76%2C19%25.

Otoo, F. N. K. (2024). Assessing the influence of financial management practices on organizational performance of small-and medium-scale enterprises. Vilakshan-XIMB Journal of Management, 21(2), 162–188. https://doi.org/10.1108/XJM-09-2023-0192

Perekonomian, K. K. B. (2022). Coordinating Minister Airlangga : Government Continues to Encourage Strengthening Economic Foundations by Establishing Digital Transformation of MSMEs as One of the Priorities. www.ekon.go.id

Rosyadah, K., Mus, A. R., Semmaila, B., & Chalid, L. (2022). The relevance of working capital, financial literacy and financial inclusion on financial performance and sustainability of micro, small and medium-sized enterprises (MSMEs). American Journal of Humanities and Social Sciences Research (AJHSSR), 4(12), 203–216. http://www.ajhssr.com/

Suryani, Hanifah Sri, R. I. (2021). Pengaruh Literasi Keuangan dan Modal Sosial Terhadap Inklusi Keuangan Masyarakat Usia Produktif di Sumbawa. Jurnal Manajemen Dan Bisnis, 4(2), 35–42. https://doi.org/http://doi.org/10.33395/remik.v4i2

Tharmini, T., & Lakshan, A. M. I. (2021). Impact of financial management practices on performance of small and medium enterprises–Legitimacy theory perspectives. Kelaniya Journal of Management, 10(1), 43–64. https://doi.org/10.4038/kjm.v10i1.7666

USAID. (2009). Development of strategy options for SME financial literacy (Issue April). https://pdf.usaid.gov/pdf_docs/PNADP093.pdf

Venkatraman, N., & Ramanujam, V. (1987). Measurement of business economic performance: An examination of method convergence. Journal of Management, 13(1), 109–122. https://dspace.mit.edu/bitstream/handle/1721.1/48491/measurementofbus00venk.pdf?sequence=1&isAllowed=y

Wahyono. (2021). The relationships between market orientation, learning orientation, financial literacy, on the knowledge competence, innovation, and performance of small and medium textile industries in Java and Bali. Asia Pacific Management Review, 26(1), 39–46. https://doi.org/10.1016/j.apmrv.2020.07.001

Widasari, E., Paniran, P., Furniawan, F., & Mufidah, F. (2024). Financial Management Practices in SMEs: Challenges and Solutions. Journal of Multidisciplinary Sustainability Asean, 1(4), 184–193. https://doi.org/https://doi.org/10.70177/ijmsa.v1i4.1520

Zayed, N. M., Mohamed, I. S., Islam, K. M. A., Perevozova, I., Nitsenko, V., & Morozova, O. (2022). Factors influencing the financial situation and management of small and medium enterprises. Journal of Risk and Financial Management, 15(12), 554. https://doi.org/https://doi.org/10.3390/jrfm15120554

Downloads

Published

How to Cite

Conference Proceedings Volume

Section

License

Copyright (c) 2025 Hariman Hariman, Martino Wibowo

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.